Letter Of Explanation Of Derogatory Credit - How To Explain Derogatory Credit Progressive Lending Solutions / A letter of explanation for derogatory items on a credit report should explain the circumstances that caused any late payments and why future late payments will not occur, according to guston cho associates.

Letter Of Explanation Of Derogatory Credit - How To Explain Derogatory Credit Progressive Lending Solutions / A letter of explanation for derogatory items on a credit report should explain the circumstances that caused any late payments and why future late payments will not occur, according to guston cho associates.. Availability of letters of credit. A letter of explanation might be requested if you have: Letters of explanations for derogatory tradelines * letter of explanations will be required for the following: Letters of explanations to mortgage underwriters is requested throughout the mortgage process. Writers should make the letter concise and only address the items the mortgage.

You may want to enclose a copy of your credit report with the items in question circled. Send your letter by certified mail, return receipt requested, so you can document that the. A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Many of your creditors report your credit limit, current account balance and payment history directly to the three credit reporting agencies. If you have a derogatory but accurate record, do your best to work around it.

Many of your creditors report your credit limit, current account balance and payment history directly to the three credit reporting agencies.

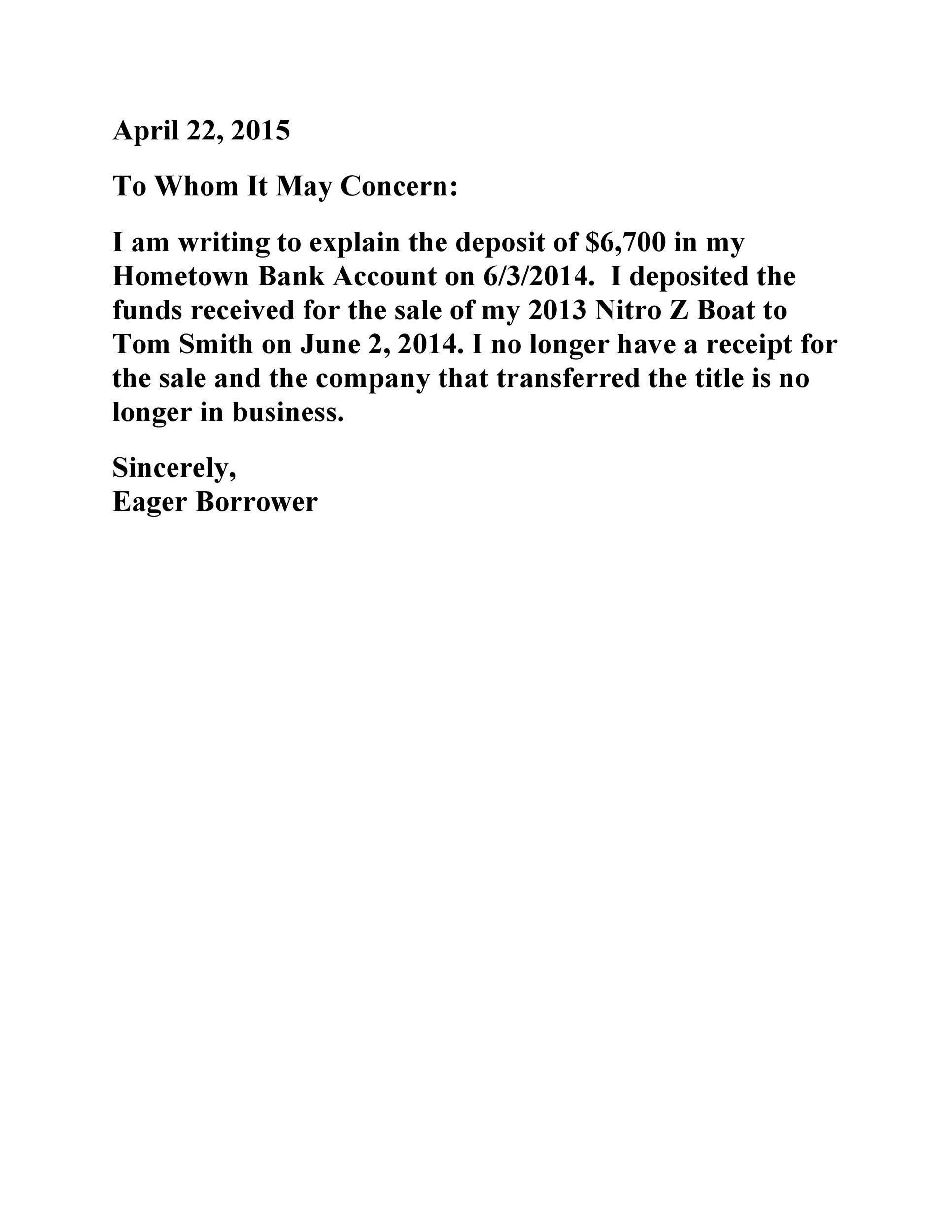

Borrower letter of derogatory credit. Add a letter of explanation to your credit file if you feel extenuating circumstances. _explanation of (please to the best of your ability; A letter of credit (lc), also known as a documentary credit or bankers commercial credit, or letter of undertaking (lou), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. The term derogatory means the information is negative and will likely hurt your ability to qualify for credit or other services. Describe the reasons for your derogatory credit and how If you have a derogatory but accurate record, do your best to work around it. If a credit bureau claims to have court verification of a bankruptcy, you should send a procedural letter to determine how they verified the public record if a tax lien is being reported on your credit report, file a dispute. If you've had multiple credit checks on your report recently due to shopping for a good refinancing offer, you can clarify the situation for the next creditor with a letter similar to the one below. Letters of explanation are requirements from secondary authorities that own or back the loan in many cases. A good credit explanation should contain the following: An acknowledgement of what happened. Credit explanation letter credit dispute letter an explanation the art of war explanation ftc staff closing letter:

If there are five derogatory items, make certain that all five. Letters of explanations to mortgage underwriters is requested throughout the mortgage process. This demonstrates honesty and understanding of make sure that your borrower's credit explanation letter corresponds with the credit report. An acknowledgement of what happened. Writers should make the letter concise and only address the items the mortgage.

The term derogatory means the information is negative and will likely hurt your ability to qualify for credit or other services.

Impact of derogatory items in your credit report. These are the types of derogatory credit items that can appear on your credit report debt settlement, resulting from an agreement between you and a creditor to reduce the outstanding balance and cancel the remainder. However, the mortgage lender can still request a letter of explanation for any derogatory information appearing on your credit report, regardless of. If you've had multiple credit checks on your report recently due to shopping for a good refinancing offer, you can clarify the situation for the next creditor with a letter similar to the one below. Many of your creditors report your credit limit, current account balance and payment history directly to the three credit reporting agencies. Borrower letter of derogatory credit. 8 how to write a good letter of explanation? If you have a derogatory but accurate record, do your best to work around it. Qualifying for mortgage with direct lender. This sample letter will help you know how to address the major credit bureaus about disputing errors on your credit report. Letters of explanation are requirements from secondary authorities that own or back the loan in many cases. When consumers experience financial difficulties that cause their credit rating to go down, they may have trouble getting new credit, a new job or insurance at a. This demonstrates honesty and understanding of make sure that your borrower's credit explanation letter corresponds with the credit report.

An acknowledgement of what happened. Send your letter by certified mail, return receipt requested, so you can document that the. You should clearly state what has caused. The term derogatory means the information is negative and will likely hurt your ability to qualify for credit or other services. Confirmation and confirmed letter of credit.

Confirmation and confirmed letter of credit.

A letter of explanation might be requested if you have: Your source of income needs explanation (e.g. 8 how to write a good letter of explanation? Writers should make the letter concise and only address the items the mortgage. The term derogatory means the information is negative and will likely hurt your ability to qualify for credit or other services. Then write a letter to the credit bureau, after the claim has been paid for by your insurance, asking the credit bureau's to take the derogatory claim off if you need to write an explanation letter of slow pay on credit, you need to include all the relevant details. Qualifying for mortgage with direct lender. 7 letters of explanation for derogatory credit. It may also refer to other information that indicates credit risk, such as bankruptcy and public records. A credit letter of explanation is written to give the detail of any credit application to the bank as per the rules of the concerned financial institute. Letters of explanation are requirements from secondary authorities that own or back the loan in many cases. You have to submit this type of letter if there are any problems. A letter of explanation for derogatory items on a credit report should explain the circumstances that caused any late payments and why future late payments will not occur, according to guston cho associates.

Komentar

Posting Komentar